When I rise, you rise along with me!

Ripple Effect

In the investing word, we know that if a company does well – awesome products/services, high demand, great sales, and profit margins then its stock is bound to do well!

Now what about the suppliers that provide components/raw materials/services to these well to do companies? There’s going to be a ripple effect! The supplier will get more orders, more revenue, and a boost to its own stock price.

A great example of this symbiotic relationship is Apple and its suppliers – companies that provide AAPL with electronic components and everything else needed to build those awesome iPhones. People tend to appreciate the final product but without these suppliers, the product would not be a possibility.

The EV (Electric Vehicle) Revolution

Tesla revolutionized the EV space and traditional auto makers have also started rolling out EVs so that they don’t fall behind.

What powers all these EVs? The massive battery packs! What goes into these batteries? LITHIUM!!!

The demand for EVs is only going to continue to rise. It’s estimated that 50% of all new car sales in the US will be electric by 2030. Naturally, there’s going to be a high demand for lithium batteries and so it makes perfect sense to own stocks of the companies involved in this sector. These are your suppliers that are making the EV revolution possible!

Don’t forget that lithium batteries also power your cell phones and several other consumer electronic goods that you rely on.

Invest in the EV space

To invest in the EV space, you can go ahead and buy individual stocks, although I believe that a better and safer way to play this sector would be to buy an ETF that holds and manages the top players. That way, you’ll mitigate your risk and exposure to specific companies.

One such top ETF is the Global X Lithium & Battery Tech ETF (LIT). LIT invests in the full lithium cycle – metal mining, refining and battery production. LIT seeks to track the performance of the Solactive Global Lithium Index.

You can buy LIT from any of your favorite brokers – Fidelity, Vanguard, Schwab etc.

LIT Facts

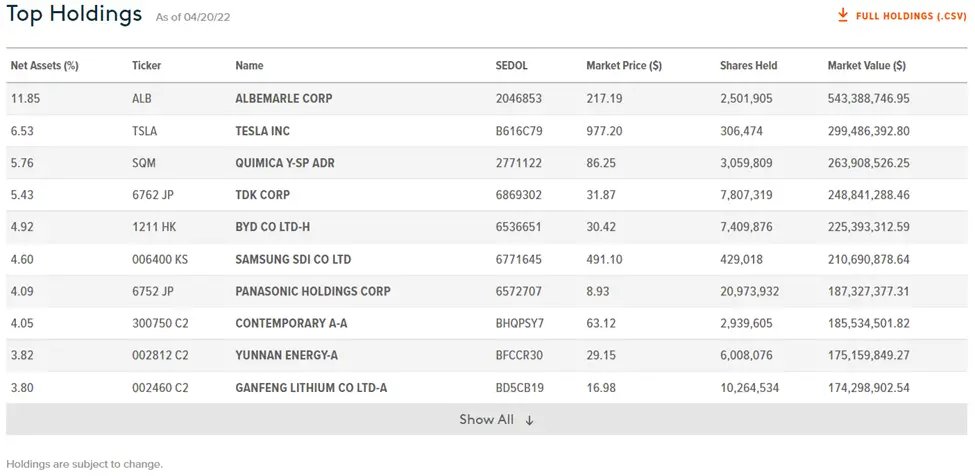

LIT facts as of 04/21/2022. Please go to Global X for the most up to date stats on LIT.

Top three holdings (subject to change):

- ALB: ‘Albemarle Corp’ based in Charlotte, NC. ALB is a is a specialty chemicals company producing Lithium, Bromine and catalyst solutions.

- TSLA: TESLA needs no introduction.

- SQM: ‘Sociedad Química y Minera de Chile S.A’ is a global mining company based in Chile. One of its lines of business is the production of Lithium and its derivatives.

LIT – Total number of stock holdings as of 04/21/2022: 41

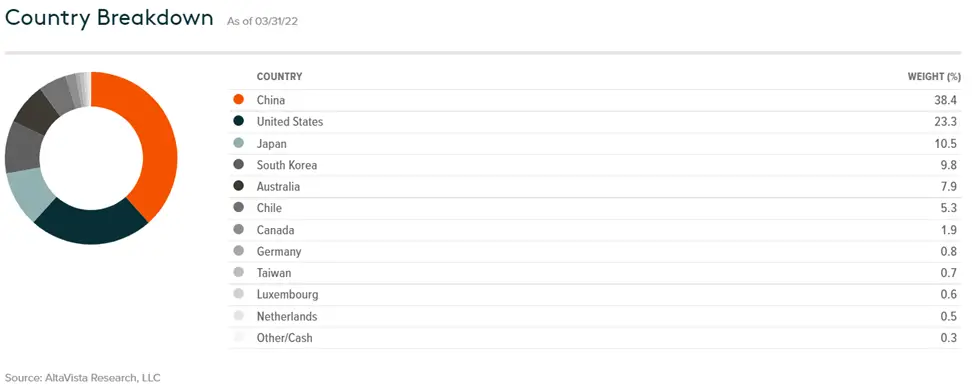

LIT has a significant exposure to Chinese companies working with Lithium and battery technology – 38.4%

BUY and HOLD!

Buying LIT is a great strategy for a long-term investor to gain exposure to the EV and supplier space. Buy it in lumpsum or in a DCA fashion and hold onto it for several years. You’ll do a great favor to your overall portfolio!

*** Disclosure: As of this writing (04/21/2022), VJ owns shares of LIT ETF and is long on LIT.

You’re right. I think the demand for lithium will continue to rise. Time to buy some LIT.

It’ll go down if they discover an alternate way to manufacture batteries without lithium.

Its a possibility but right now lithium rules the rechargeable battery world.

Even if that happens, it’s not gonna happen anytime soon. Till that time we can reap the benefits of investing in lithium and related battery stocks.

What if cars find an alternate power source? Hydrogen, Natural gas etc?

These alternate sources for powering cars have been around for a while but they haven’t gained as much attention as EVs.

With all the big car companies entering the EV market, the demand for lithium will surely rise. I’m also hearing that lithium is not renewable and reserves are limited. It’s not going to be the end of lithium anytime soon though.

My next car is probably going to be electric…tired of the high gas prices plus I don’t drive long distances.

Tired of the crazy gas prices! Planning to replace my old car with an EV – probably the VW ID.4. Think I should buy some LIT as well.

I have a Prius which is best of both worlds.

Still too expensive to buy EVs. Hopefully the prices will come down in the next few yrs.