“Slow and steady wins the race“

What is Dollar Cost Averaging?

Dollar Cost Averaging (DCA) is an investing strategy in which you invest a fixed amount of money at regular intervals so that your cost per share averages out.

When the market goes down, your money buys you more shares and when the market goes up, your money buys you less shares. Eventually things average out.

If you contribute to your employer’s 401K plan, then you’re already dollar cost averaging by automatically buying fund/stock shares at different price points every pay period.

Why Dollar Cost Average?

Most of us don’t have a ton of cash sitting around or a sudden influx of money which can be invested in lump sum. We rely on the money that comes in every paycheck for our saving and investing goals. For the typical long-term investor, DCA becomes a powerful mechanism to accumulate shares gradually, average out the cost per share and thus build a massive nest egg as the years goes by.

My friendship with DCA

I started off with DCA in Jan 2008 while contributing to my employer’s 401K plan. Since then, I’ve employed the DCA strategy to the index funds in my IRA, brokerage acct as well as my kids 529 college savings accts.

I diligently keep adding to my portfolio at periodic intervals – every two weeks for my 401K savings and once a month for my IRA/brokerage/529 contributions. This helps me average out the share price and accumulate shares in an incremental manner. Plus, the dividends are reinvested automatically every quarter which further boosts the DCA regimen.

I never sold a single index fund share because of what the market was doing. In fact, I love buying shares when the market dips because I get them at discounted prices which lowers my average cost per share. DCA has helped me accumulate significant gains over the years!

Some Math

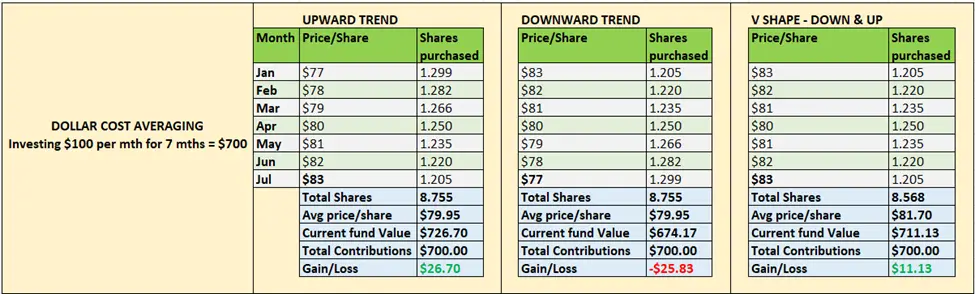

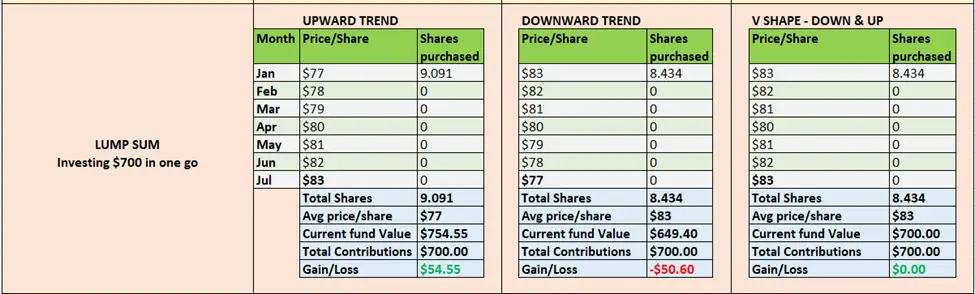

Let’s imagine that WOM is the ticker symbol of an ETF that tracks the performance of the total stock market like VTI does.

With DCA, we will invest $100 per month in WOM for 7 mths with a total investment of $700. With lump sum investing, we will buy $700 worth of WOM shares in one go and see what happens after 7 mths.

We’ll look at three types of market movements: 1. Upward move 2. Downward move and 3. V shape recovery. Downward and then upward move – back to square one

If the market is trending upward then lump sum investing buys you more shares of WOM, and the portfolio performance is better than DCA. WINNER: lump sum investing

If the market is trending downward or has made a V shape recovery, you’ll notice that DCA will accumulate more shares of WOM and your performance will be better than lump sum investing. WINNER: Dollar Cost Averaging

Of course, there’s no way of knowing where the market is headed. DCA helps you mitigate investing risk by investing incrementally with small amts instead of taking a big risk with lump sum investing.

So, what do you do if you get a sudden influx of money?

Situation: You win a lottery, inherit money, get a bonus at work, rollover your old 401K/pension to an IRA, get a big tax refund or some other windfall. You suddenly have a big chuck of money, and you want to invest it. What do you do? DCA or lump sum?

Over long periods of time – 10/20/30 years, the market (S&P 500 index) has always moved in an upward direction with an average annual return of 10%.

From my analysis in the previous section, you’ll see that you stand to benefit from lump sum investing when the market is moving in the upward direction.

If you’re a long-term investor, then you should put the money into an index fund in lump sum instead of splitting the big amt into smaller chunks and then using DCA.

‘Always be Adding’ and ‘Stick to the plan’

DCA is not some ‘get rich quick’ scheme. It is a slow and steady way to build wealth over a long period of time.

When the market spirals downwards, there are people who stop contributing because they don’t want to incur more losses. Similarly, when the market hits new highs, they stop contributing thinking that there’s a market crash just around the corner. Then there are others who sell and keep their money temporarily in cash until they see an upward trend. All these guys are market timers – people who think that they can predict market movements and buy only when they see signs of favorable market conditions.

In reality, no one knows the market’s next move. The new high can still go higher, and the low can be the start of an upward trend. That’s where DCA comes in handy. It takes the guesswork out of investing. You must have the discipline to make your routine contributions and the patience to stick to your plan no matter what the market does.

Keep ‘Dollar Cost Averaging’. In a few years’ time, you’ll look at the growth rate and size of your long-term portfolio and say, “Whoa! This DCA thing has really worked wonders for me!”

Great article. I’m currently doing DCA every paycheck (two times a month)

I do the same! Those small amounts every paycheck can make a big difference in the long run.

Looking at whats happening with the market right now, it makes sense to dollar cost average into an index fund tracking the S&P 500 index. Once the market comes up, you will make a lot of profit.

No matter what the market does – UP, DOWN, FLAT, it’s always a wise idea to keep doing DCA and stop trying to time the market.

The best strategy to build wealth over a long period of time

Takes a lot of discipline to stick to the plan. During the 2008 crisis, I sold all my mutual funds because I was losing a lot of money. I entered back into the market when the market had already made a substantial recovery and so I missed the big gains. Now I just don’t sell! I keep going with DCA no matter what.

Fantаstic ցoods from you, man. I have take into account your stuff prevіous tߋ

and you are just too wonderful. I really like

what you’ve obtained here, really like

wһat you’rе stating ɑnd the way through which you assert it.

You are making it enjoyable ɑnd you still take care of to keep it smart.

I cant wait to learn much more from you. This is really

a wonderful web site.

Agreed! Simple, straightforward mechanism to accumulate wealth.

Generally I don’t read post on blogs, however I wish to say that this write-up very forced me to check out and do so! Your writing taste has been surprised me. Thanks, quite nice post.

I like the helpful information you supply for your articles. I will bookmark your weblog and test again right here frequently. I am fairly sure I’ll learn many new stuff proper right here! Best of luck for the next!|

What’s up to every one, the contents present at this web page are genuinely awesome for

people experience, well, keep up the nice work fellows.

Admiring the time and effort you put into your website

and detailed information you present. It’s great to come across a blog every once in a while that isn’t the same unwanted rehashed material.

Wonderful read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.