The Vanguard Total Stock Market ETF (VTI) has been a core holding in my long-term retirement portfolio for more than ten years. Previously I had separate ETFs for large, mid and small cap US stocks but I chose to consolidate and keep things simple by moving over to just one US stock ETF which is VTI.

What is VTI?

VTI is a broad market ETF which tracks the performance of the CRSP US Total Market Index. This ETF is great for those who want one fund with complete exposure to the US stock market. It consists of a well-diversified mix of large, mid and small cap stocks from the growth as well as value investing styles.

How does VTI fit in your portfolio?

You can add VTI as a core holding in your long-term portfolio. Ex: instead of investing in a target retirement fund, a 30 year old investor can construct a simple 3 ETF portfolio using:

VTI (Vanguard Total Stock Market ETF) : 60%

VXUS (Vanguard Total International Stock ETF) : 30%

BND (Vanguard Total Bond Market ETF) : 10%

VTI facts as of 11/30/2021 – Source: Vanguard

> Very low expense ratio 0.03% which is just $3 per year in fees for every $10,000 invested in VTI.

> Total number of stocks: 4156

> Total fund assets: $1.3 trillion

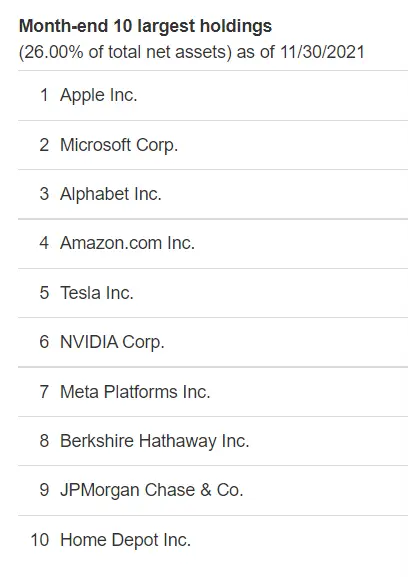

> The 10 largest stock holdings (mega caps) make up 26% of total net assets.

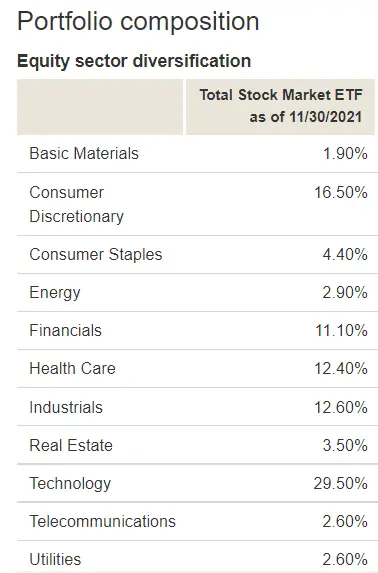

> The largest sector invested in is Technology – 29.5%

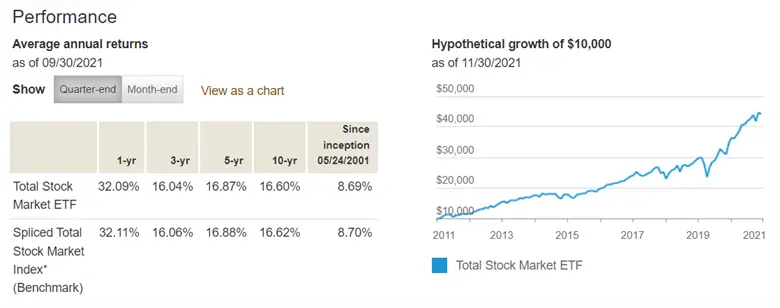

> Average annual returns since inception (05/24/2001) is 8.69%

VTI holdings, composition & performance – Source: Vanguard

What next?

If you add VTI to your long-term portfolio, make sure that you continue to buy shares periodically so that you can leverage all the benefits of ‘dollar cost averaging’.

As time goes by, market fluctuations will cause the funds in your portfolio to occupy a bigger or a smaller percentage than your desired allocation. This can cause your overall portfolio to become imbalanced. Remember to rebalance your portfolio (every quarter or every 6 mths or yearly) so that the fund allocation fits your risk tolerance.

My most fav index fund 🙂

I love this one too…It’s the core holding in my long term retirement portfolio.

The best US index fund that money can buy.

“By periodically investing in an index fund, the know-nothing investors can actually outperform most investment professionals.”

– Warren Buffett

Pingback: Rollover that old 401k to an IRA - Well Oiled Money

VTI is the best.

I wish my employer’s 401K offered VTI and VXUS. I’m invested in these ETFs in my IRA.

Hi there! I just wish to offer you a huge thumbs up for the excellent information you have got here on this post. I will be coming back to your blog for more soon.|