A brief history

The first laptop that I bought with my own money was a Dell Inspiron way back in 2003. At that time, I was a grad student studying Computer Science. In 2009, the screen went blank, but I was still able to use the machine by hooking it up to an external monitor. The interesting thing is, I still have the Dell with me after nearly 19 years! Of course, it doesn’t work but I’ve kept it as a memory.

When I bought the laptop, I chose the option to get an NVIDIA graphics card. At that time, NVIDIA was, and it still continues to be the best in class GPU company with top of the line processors. All the machines that I’ve owned since then have had an NVIDIA chip inside them.

The NVIDIA trade

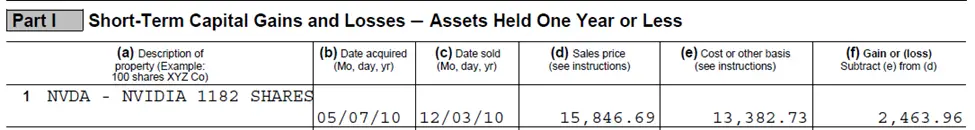

The year was 2010. The core holdings of my long-term portfolio were index mutual funds, but I was also trading a lot of individual stocks. Most of them were short term trades that lasted only a few mths. NVDA was one such trade that I regret selling. Why? Have a look at my 2010 tax return, schedule D:

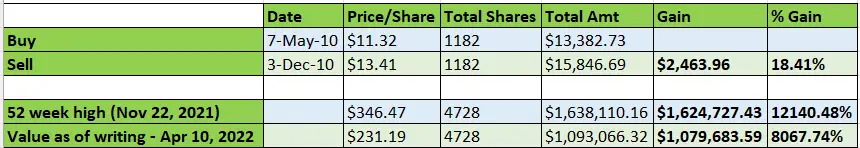

I owned 1182 shares of NVDA in May 2010 and I sold them in Dec 2010 for a profit of $2,463.96 which was an 18% return in 7 mths.

If I didn’t sell, I would have had 4,728 shares (4:1 split on July 20, 2021) valued at $1,638,110 when the shares hit a 52 week high.

On April 10, 2022, the shares would be valued at 1 mill 93K which is still a crazy growth considering that my initial investment was just 13K.

Why am I talking about this?

The history section in the beginning of this article is not to bore you with mundane life events. I want to stress the fact that – “if you love using a company’s products and if tons of other individuals/organizations feel the same then that’s a winning stock”. BUY IT!!!

Once you’ve bought the winning stock, you may not want to sell it unless there is a genuine reason to do so. Ex: the company and its products have since deteriorated, there is a competitor that is doing much better and taking away market share, the stock price has fallen below your loss threshold, you need the money to fund an important life event etc. etc.

The reason why I sold NVDA in 2010 is because I wasn’t disciplined enough. I had a fear that I would lose the gains and get into a loss. With individual stocks, I would just keep hopping and I held onto each stock for less than a year. Over the years I’ve gotten much better with handling individual stocks but the thought of holding onto NVDA – ‘could have should have’ still remains! 😊

Nice article. You would have made a killing if you had held onto NVDA 🙂

I know but at that time, I had put in a lot of money and was getting anxious about where NVDA would go.

It could have also gone to 0 🙂

Yes and that’s why I got out with the little gain that I had.

With the boom around AI, smarter/self driving cars, crypto etc, NVIDIA will continue climbing higher over the next several yrs.

Great company with awesome GPU products

Couldn’t agree more! All the machines that I’ve owned over the years have had an NVIDIA GPU.

Hi there would you mind letting me know which webhost you’re using?

I’ve loaded your blog in 3 different internet browsers and I must

say this blog loads a lot quicker then most. Can you suggest a

good hosting provider at a fair price? Thanks a lot, I appreciate it!

Hi. I use Bluehost for hosting and EZOIC for CDN/caching.

I did something similar with MU. Sold too soon but hey, u never know what’s going to happen with a stock.